Canada T2 Corporation Income Tax Return 2023-2026 free printable template

Show details

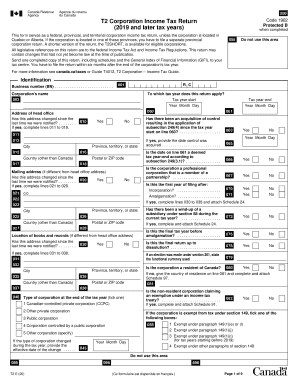

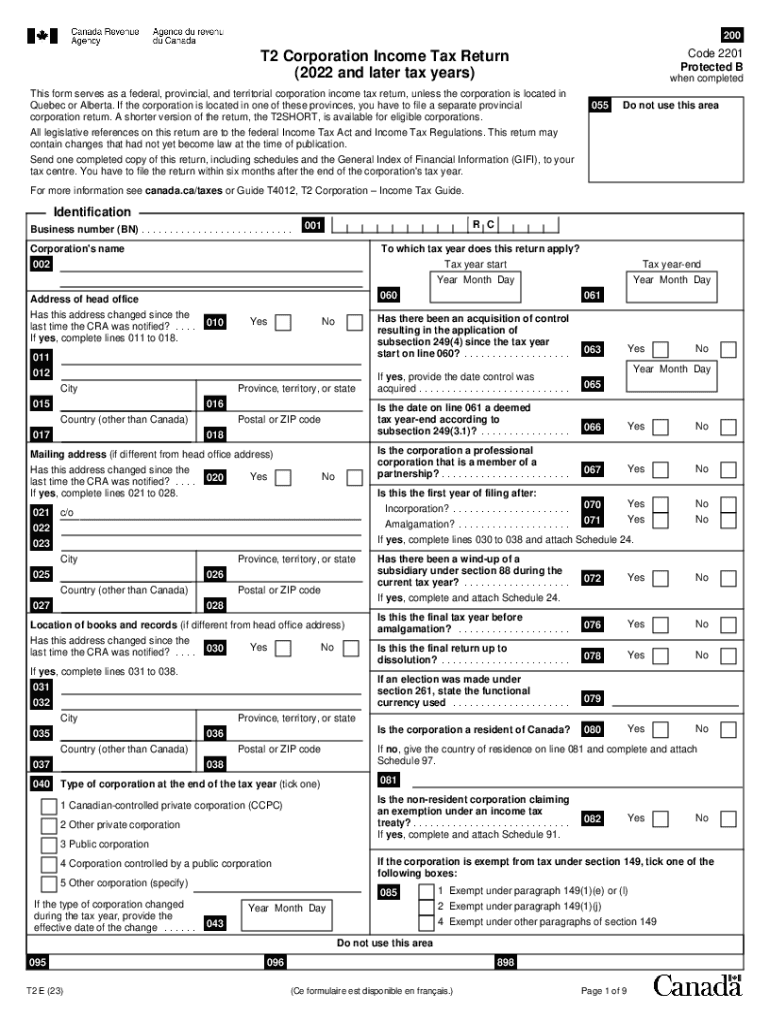

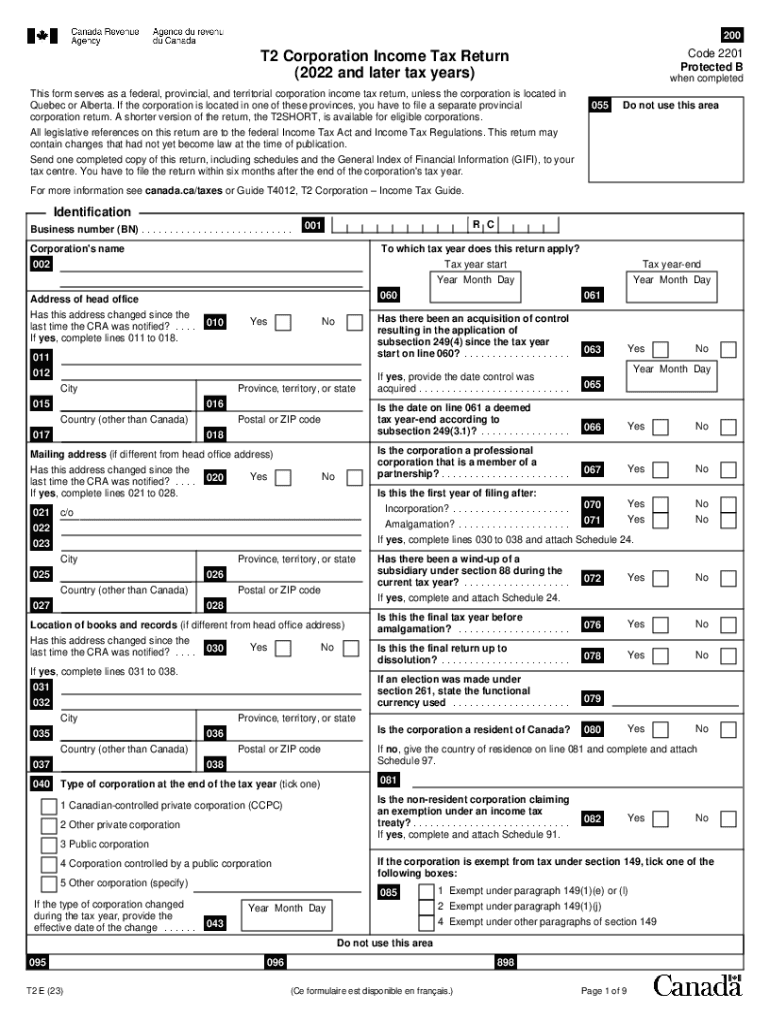

200Code 2201 Protected BT2 Corporation Income Tax Return (2022 and later tax years) This form serves as a federal, provincial, and territorial corporation income tax return, unless the corporation

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign canada t2 form

Edit your blank t2 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t2 corporation tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit get t2 form online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit canadian t2 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2 Corporation Income Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t2 income tax form

How to fill out Canada T2 Corporation Income Tax Return

01

Gather all necessary financial documents including income statements, balance sheets, and prior tax returns.

02

Complete the T2 form including identification information for the corporation such as name, address, and Business Number.

03

Calculate total income including revenue from sales, investments, and other sources.

04

Deduct allowable expenses such as wages, cost of goods sold, and operational expenses to arrive at taxable income.

05

Apply any applicable tax credits and deductions as allowed under Canadian tax law.

06

Complete the sections for specific tax calculations including federal and provincial taxes.

07

Review and ensure all information is accurate and complete.

08

Sign and date the return, ensuring that it is submitted to the Canada Revenue Agency by the due date.

Who needs Canada T2 Corporation Income Tax Return?

01

Any corporation operating in Canada, including Canadian-controlled private corporations and non-resident corporations earning income in Canada, must file a T2 Corporation Income Tax Return.

Fill

return form canada

: Try Risk Free

People Also Ask about t2 form canada 2024

What type of business is 1120?

Domestic corporations use this form to: Report their income, gains, losses, deductions, credits.

How do I get a T2 document?

To order a T2 return by phone: From anywhere in Canada and the United States, call 1-800-959-5525 from Monday to Friday (except holidays) 9 am to 6 pm (local time), Saturday and Sunday closed. From outside Canada and the United States, 613-940-8497. The CRA only accepts collect calls made through a telephone operator.

Who files form 1120?

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120, unless they are required, or elect to file a special return.

Is form 1120 for C corporations?

C corporations must file Form 1120 each year, whether or not they have taxable income for that period.

What is a T2 form?

What is a T 2 Form? A T-2 form is a postcard mailer that many senior citizens are receiving in the mail.

Are there 3 types of tax return forms?

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS. Differences in the forms, however, could cost you if you're not paying attention.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get t2 corporation tax return?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the t2 document canada in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute canada t2 corporation tax return online?

pdfFiller has made it simple to fill out and eSign t2 corporation tax return form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit t2 tax return fillable straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing t2 form canada tax return.

What is Canada T2 Corporation Income Tax Return?

The Canada T2 Corporation Income Tax Return is a tax form that corporations in Canada must file to report their income, calculate their taxes owed, and declare any credits or deductions applicable to their taxable income.

Who is required to file Canada T2 Corporation Income Tax Return?

All corporations operating in Canada, including public and private corporations, non-profit organizations, and tax-exempt organizations, are required to file a T2 return, regardless of whether they earned income or not.

How to fill out Canada T2 Corporation Income Tax Return?

To fill out the Canada T2 return, corporations must gather their financial records, complete the appropriate sections of the T2 form, including income, deductions, and taxes payable, and submit the return to the Canada Revenue Agency, ensuring accuracy and compliance with tax regulations.

What is the purpose of Canada T2 Corporation Income Tax Return?

The purpose of the Canada T2 Corporation Income Tax Return is to report a corporation's financial activities to the Canada Revenue Agency, calculate the amount of tax owed, and ensure that the corporation complies with federal tax laws.

What information must be reported on Canada T2 Corporation Income Tax Return?

The T2 Corporation Income Tax Return requires reporting details such as the corporation's income, eligible expenses, tax credits, dividends paid, capital gains or losses, and any other relevant deductions and adjustments necessary for tax calculation.

Fill out your Canada T2 Corporation Income Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t2 Corporation Income Tax Return is not the form you're looking for?Search for another form here.

Keywords relevant to t2 general

Related to canada t2 forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.